In today’s fast-paced world, money moves quickly, and it can slip through your fingers like sand if you’re not paying attention. Managing your finances isn’t just about making sure you can pay the bills on time (although that’s crucial); it’s about securing your future, one dollar at a time.

Personal financial control means keeping a close watch on your financial activities, ensuring that you live within your means, and planning for the future. Here’s why it’s important:

- Budgeting and Spending

Knowing where your money goes each month is fundamental. By maintaining control, you can allocate funds wisely, avoid unnecessary debt, and save for future needs.

- Emergency Preparedness

Life is unpredictable. Having a financial cushion can help you manage unforeseen expenses without plunging into financial turmoil.

- Investment and Savings

Effective financial control allows you to accumulate wealth, invest in opportunities, and ensure a comfortable retirement.

- Debt Management

Keeping track of your debt and managing it effectively is crucial to financial health. Controlled personal finance means you can strategise to pay off debts more efficiently.

- Financial Goals Achievement

Whether it’s buying a home, funding education, or planning a holiday, disciplined financial management is key to achieving your goals.

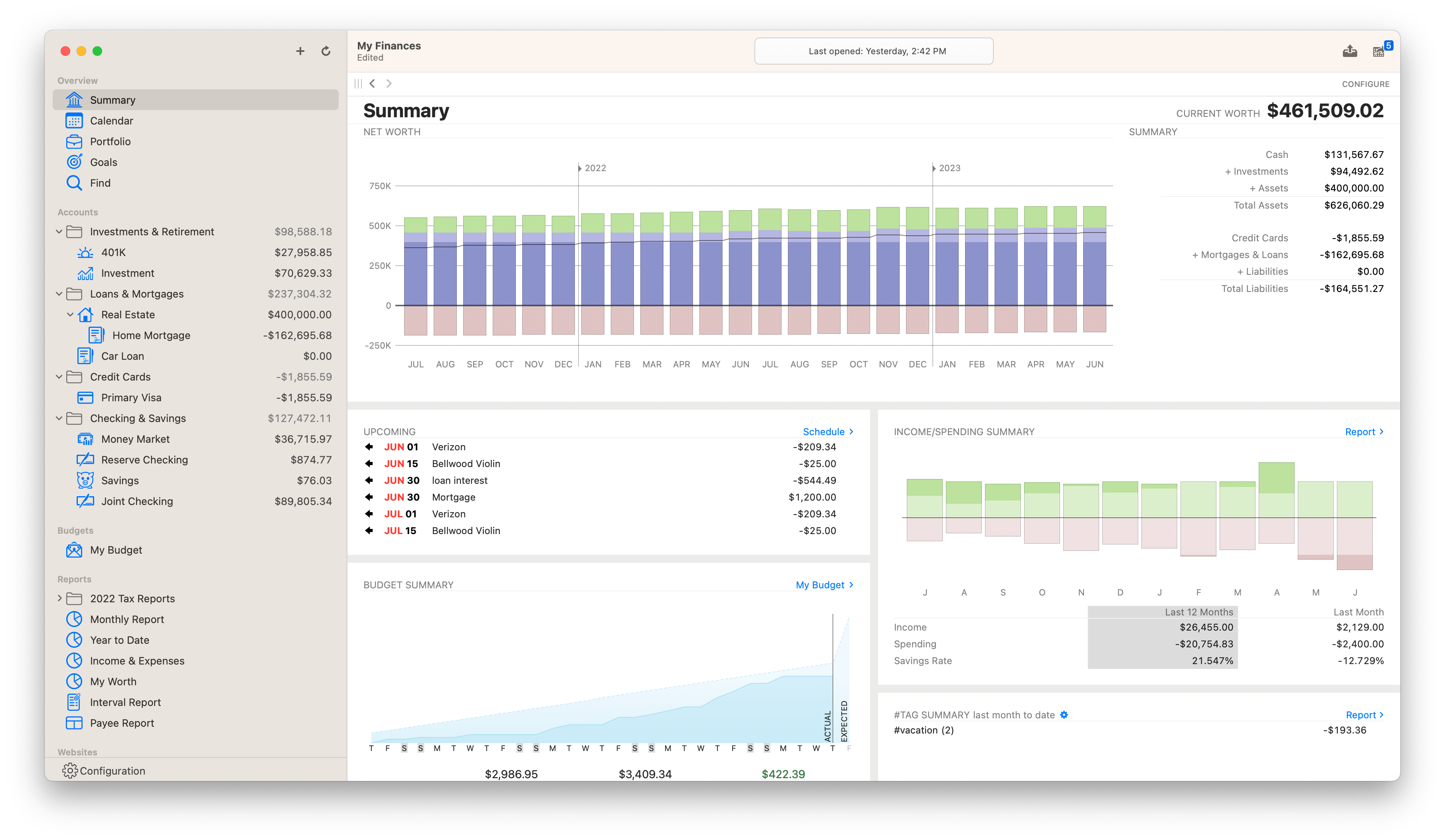

Banktivity is an excellent tool for Apple users seeking to take charge of their financial destiny. By using this app, you can streamline your financial management process, making it easier to achieve your financial goals and secure your economic future.

Now, let’s talk about how Banktivity fits into this financial tapestry. For those who bleed Apple, Banktivity is the financial toolkit designed to synergise with your Apple ecosystem. Here’s why it’s a game-changer:

Banktivity integrates flawlessly with macOS and iOS, offering a user-friendly interface that feels right at home on your Apple device.

With Banktivity, budgeting becomes a breeze. The app provides detailed insights into your spending patterns, helping you stay on track with your financial goals.

Keep your investments in check with real-time portfolio updates, performance analysis, and market research tools.

Banktivity’s planning features, like scenario testing and future projections, help you navigate your financial future with confidence.

Your financial data is sensitive, and Banktivity ensures it’s safeguarded with robust encryption and security measures. All data is stored on device.

Banktivity offers tools for tracking debt, creating repayment plans, and visualising the impact of different strategies on your financial goals.

Banktivity sets itself apart from other personal finance apps offers comprehensive financial management features, superior data accuracy, and robust customer support, making it a valuable investment for serious finance management on your Mac and iOS device.

You can manually enter data into Banktivity, upload transaction data exported from you bank or connect Banktivity to your Bank to automatically download data. Importantly where available Banktivity can utilise Open Banking making the process even more secure.

After trying all the major personal finance apps such as Pocketsmith, Moneydance and Frollo the one feature that makes Banktivity standout above the other is it allows you to create multiple sets of accounts. I for example have my personal account plus separate accounts for my business, a Strata Company and 2 Trust Estates.

You can try a 30 Day free trial of Banktivity to see how well it will improve your finance management.